Budgeting apps are great tools to assess your spending habits and track your finances such as income, expenses, savings, and more. Most apps sync with your bank accounts and organize your spending into categories to help you identify trends, save money and meet your budget goals.

In search of the best budget app for seniors, we have looked into different options to find the perfect budget app for retirees. Here are the 7 best budget apps for older adults on the basis of senior-friendly features, ease of use, security features, and user ratings.

Related: Best Frugal Living Blogs for Older Adults | 15 Must have apps for seniors

7 Best Budget Apps for Seniors

- Mint: #1 Most downloaded app with most feature for a budgeting app

- Pocket Guard: The best budget app for seniors with senior-friendly features

- Goodbudget: Best for budget planning using “envelop budgeting”

- YNAB: Best for hands-on zero budgeting

- Every Dollar: Free & simpler alternative to YNAB

- Honeydue: Best budgeting app for couples

- Fudget: Ultra simple, easy and basic budget app

Let us have a look at each one of these apps in details.

1: Mint

Mint brings together all of your finances and gives you a clear picture of your financial situation. This app allows seniors to link all bank accounts in one place. You can add credit cards, investments, mutual funds, 401Ks, and bills in one app.

Mint helps you track your spending and alerts you when you surpass the designated spending limit. You can set reminders to pay bills from the app, so you never miss a payment. The charts break down spending into categories (such as gas, groceries, and entertainment). It gives you a snapshot of your spending to help cut down and make better financial decisions.

The overview section provides budget alerts, account totals, spending, monthly budget totals, and a breakdown of categories.

Mint analyzes your spending habits and makes suggestions to save money in many areas.

Mint is the most popular budget app with 24 million+ users. You can feel safe that it won’t be hacked or compromised because it is created by Intuit, an excellent company and creator of QuickBooks and TurboTax. Mint is also one of the few good budget apps that are completely free to use. You can use it on a desktop computer, tablet, android, or iPhone.

Pros

- Number 1 budget app with 24 million+ users

- Features: Shows income, expenses, savings, goals, credit score, and more. Personalized insights, spend tracking and subscription monitoring.

- Your financial accounts and spending in one place

- Security Features: Multi-factor authentication and VeriSign scanning

- Free: One of the few features-loaded budget apps that are free to use

Cons

- Excellent for tracking your expenses and past transactions but less about planning in advance

2: Pocket Guard

Pocket Guard simplifies personal finance and budgeting for older adults. You can connect your bank accounts, credit cards, loans and investments, and bills or have the option to track your finances manually without linking your accounts.

It is easier to set up and use as compared to other apps and actually wants to help you spend less by looking for ways to save and find better deals on expenses such as phone, cable, and internet.

The app automatically categorizes the expenses, you can create your own custom categories and set spending limits for them. It also displays how much money is available for everyday spending by factoring upcoming bills and saving goals etc. from the user’s income.

The best features of Pocket Guard include.

- The “In My Pocket” feature: This is my favorite feature that helps you know what’s in your pocket. A budget is the difference between income and expenses. You are doing well if it is positive. Always know the actual safe-to-spend amount.

- SMART Goals: The app helps you set SMART (specific, measurable, achievable, relevant, and timely) goals. This makes Pocket Guard the best budget app for retirees who want to travel. Saving for a trip to Europe? Create a custom category to save a small amount each month. You can create categories for overall savings and bills etc.

- Senior Friendly budgeting app: It is easy to set up and use as compared to other budgeting apps. You have options to link your accounts or manage them manually. The app automatically categorizes expenses and gives you simple budget snapshots. Pocket Guard is big on simplifying and has plenty of senior-friendly features.

The features to set up financial goals, comprehensive analytics, ease of use, and “In My Pocket” feature make Pocket Guard the best budget app for seniors.

Pros

- The “In My Pocket” feature shows how much money you have by subtracting bills and saving goals

- Senior Friendly: Easy to set up and use

- Helps you spend less by finding deals on phone, cable, and internet

- Set SMART goals to save for travel trips and more

Cons

- Good for a hands-off experience but not ideal to plan for your money in advance

Get Pocket Guard on iPhone | Android

3: Goodbudget

Goodbudget mimics a real-life approach and works on the idea of putting your money into virtual envelopes. It is more about planning your finances than tracking your expenses. You divide the portions of your monthly income toward different spending categories (called envelopes).

The app allows you to manually add balances from your bank, cash amounts, debts, and income, and sign money towards envelopes. It does not connect your bank accounts.

The best features of Goodbudget include.

- Manage money with partners: Perfect for sharing a budget with a spouse, family members, or friends. Sync across iPhone, Android, and the web. Stay on the same page about finances with your partner.

- Insightful reports: Spendings are shown by envelope reports. Nice-looking pie charts and income vs spending reports make it easy to modify the budget after analyzing.

- Save for big expenses: The envelop strategy makes it easy to save for big-ticket items. When your social security, paycheck, or pension arrives, you can divide it into envelopes and make a separate envelope for your next travel plan or purchase.

The free forever version is ad-free and includes 10 envelopes. You can use the basic version to plan and track your spending and divide regular expenses like bills, groceries, travel, etc. The paid version comes with unlimited envelopes and more features.

Pros

- Virtual Envelopes: Excellent feature for planning and tracking your finances where you can divide money toward different spending categories (called envelopes)

- Save Money: Create a virtual envelope to save for big-ticket items and put a percentage of your saving into that envelope.

- Does not connect with bank accounts: Manually add balance from your account, cash amounts, debts, and income. No need to add bank accounts

- Works well for couples and partners

Cons

- You can’t sync bank accounts and need to enter every expense

- The free version allows 10 envelopes

Get Goodbudget for iPhone | Android

4: YNAB

One thing YNAB has in common with Goodbudget is that it allows you to plan ahead for your financial decisions, rather than tracking past transactions. One different feature of YNAB is its focus on teaching users to make better spending decisions to reach their financial goals.

The key features of YNAB include:

- Zero-based budgeting: When you get paid, tell YNAB how much of your income should go toward various categories (expenses, goals, savings). You are prompted to actively decide what to do with your money.

- Excellent guidance resources: YNAB helps you with decision-making. To trek up the learning curve, YNAB’s website offers educational resources describing how to budget and use the app.

The app works with smartphones, desktops, iPad, Apple Watch and Alexa.

Pros

- Zero-based budgeting: Plan ahead for financial decisions

- Link your bank accounts and assign your income to various categories

- YNAB helps you with decision-making and saving money

Cons

- Although the app has a free 34-day trial, it costs $14.99/month or $99/year.

- You have to keep up with YNAB. You need to get hands-on while panning for money

Get YNAB on iPhone | iPad | Android

5: Every Dollar

Dave Ramsey, the creator of Every Dollar, believes in an approach of budgeting where you decide where “every dollar” goes, at the beginning of the month. All income is allocated for spending or saving.

Every Dollar uses the same “zero-based budgeting” concept as YNAB but it is a simpler, easier, and free alternative to YNAB. In the free version, you do not sync the accounts but rather manually incoming/outgoing money.

You can categorize the line items and set up reminders for bill payments. The premium version allows you to connect bank accounts and provides custom reports.

Pros

- You decide where “every dollar” goes.

- Free, simple, and easier alternative to YNAB

- You can’t sync accounts. Manually enter incoming and outgoing money

Cons

- The free version is very basic

- The premium version is pricey ($12.99/month or $79.99/year)

Get Every Dollar on iPhone | iPad | Android

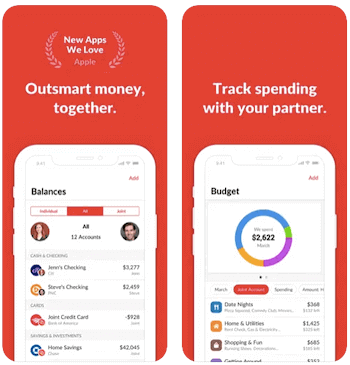

6: Honeydue

Honeydue is the most popular budgeting app for couples. It enables you to track your balances, budgets, and bills with your partner. Both partners can syn bank accounts, credit cards, loans, and investments (it is up to you to decide how much you want to share with your partner).

The app can automatically categorize your expenses or you can create custom categories and set up monthly limits together. You get reminders of upcoming bills and can have a chat and send emojis to your partner.

Honeydue is the best budget app for seniors who want to manage finances with a partner. It is featured by Apple and Forbes as one of the best budget apps for couples.

Pros

- Ideal app for budgeting with partners

- Reminders for upcoming bills.

- Chat with your partner and send emojis

- Both partners can sync bank accounts and credit cards etc

Con

- Like a few other apps, Honeydue is great about learning your past transactions, rather than helping you with planning ahead.

Get Honeydue on iPhone | Android

7: Fudget

Fudget is the best option if you do not want to sync your financial accounts and prefer a straightforward calculator interface over fancy features. The simple design is ideal for tracking incoming and outgoing money and balance.

1 million+ users love Fudget’s easy-to-use interface. It “takes the stress out of managing your money” according to Engadget and Forbes considers it “Good for tracking short-term budgets for holidays, vacations, or for tracking work expenses”.

Fudget has a less-is-more approach which makes it the best budget app for retirees who prefer a simple tool to keep a record of their expenses.

Related: Best Retirement Planning Blogs

Pros:

- Ultra-basic design and simpler than other apps

- Learn interface in minutes, one-tap adding and editing

- Use it monthly, weekly, or whenever you want

- Passcode lock or touch ID login

Cons:

- Too simple if you prefer categorization of expenses and detailed reports

Get Fudget for iPhone | iPad | Android

There you have it. The list of our top 7 picks for the best budget app for seniors.

Each of the above apps enjoys excellent ratings and reviews on App Store and Google’s Play Store.

You can also use AARP’s Budget Builder tool. It can help you plan for your budget goals and savings. You can use it on smartphones, computers, or tablets. It is a free tool and you do not need to be an AARP member to use it.